Staying relevant to the customers’ needs has never taken more precedence for banking enterprises than it has today. Neo banks and fintech entrants took up the herculean task of changing the customers’ mindset, and have succeeded. These businesses are now playing a significant role in the average consumers’ lifestyle choices.

Even adjacent businesses such as e-commerce platforms and aggregators have caught up on this trend. EMI offers such as “Buy now, pay later” are receiving great traction on digital marketplaces. Customers have now come to expect the same experience from all business interactions. They look to their financial partners for more than check-ins on account balances and accumulated interests.

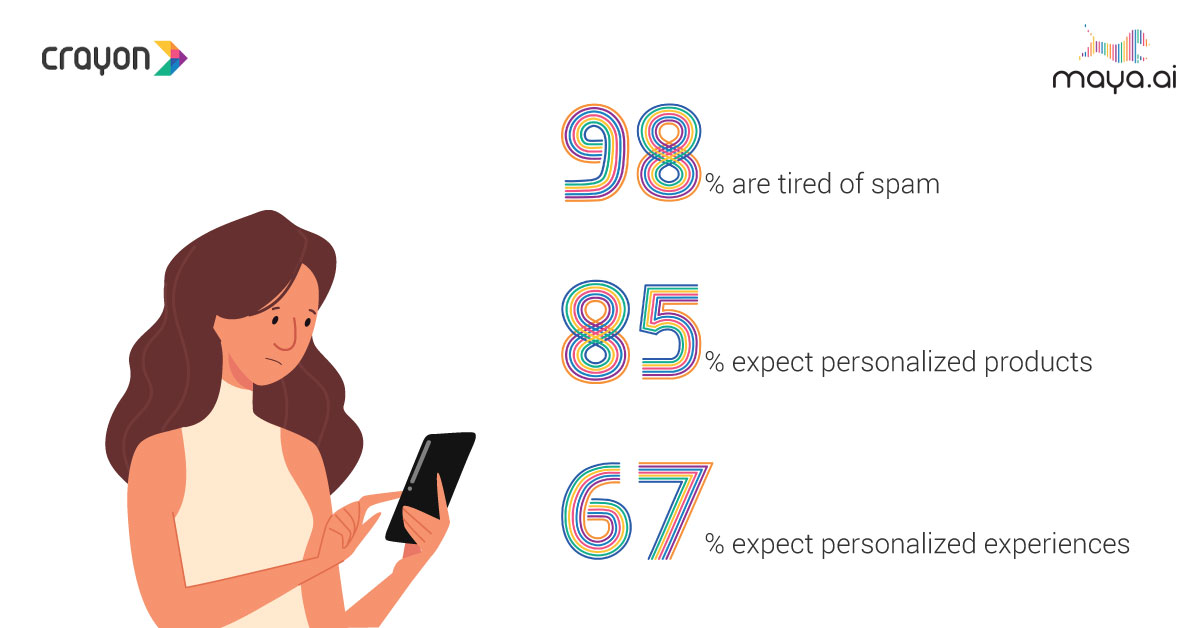

Staying relevant to consumers’ demand for personalization across products, services, and experiences.

Today’s customers are digital natives; they’re unwilling to settle for anything that doesn’t exceed their expectations. The need of the hour is not just fulfillment, but convenience. After decades of fragmenting services to garner more options, customers now want seamless and unified experiences across functions and industries. This paradigm shift is forcing enterprises to be data-driven, proactive, and collaborative.

Commerce Studio: Turning daunting tasks into exciting opportunities

Banking enterprises have made attempts to monetize through their presence on social media platforms. But the monopoly of such platforms has thwarted these efforts. In parallel, merchants are pigeonholed into showcasing their products and services on limited avenues that don’t give them adequate visibility. With maya.ai, banks can now leverage their digital assets to provide a consistent experience across various channels. They can incentivize the customer’s purchase decisions through strategic partnerships. While monetizing their own channels by earning affiliate revenue.

‘Stronger together’ may not have worked for Hilary Clinton, but it sure works for us.

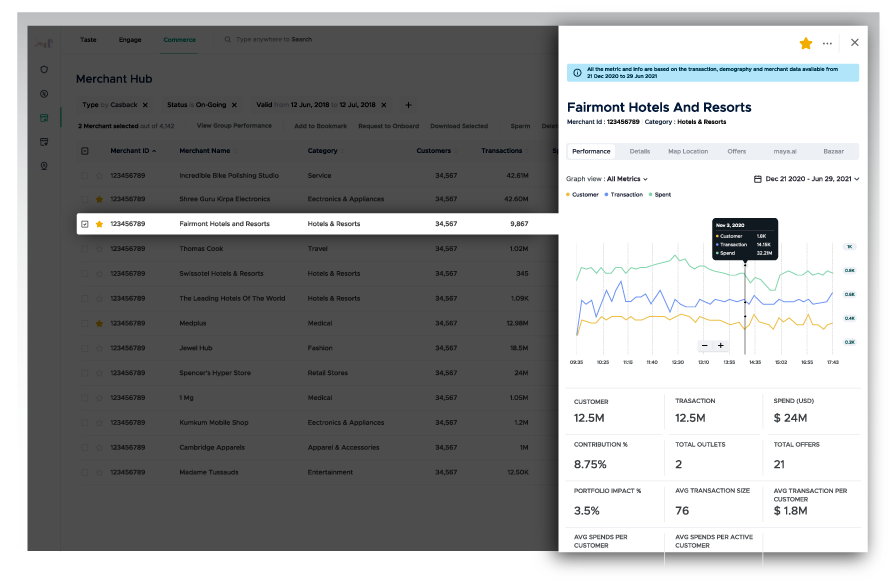

Commerce Studio fosters cross-industry collaboration and hassle-free partner acquisition. The result: increased customer engagement for banks. With traditional acquisitions, banks spend time and resources to find, engage, and groom merchants. If they want to maintain a healthy offer portfolio that is! But with Commerce Studio, collaboration is as easy as approving or rejecting offers.

Enterprise users can find data and insights such as cross-merchant affinities and projected spends. This helps them make informed and strategic decisions about who they should be partnering with. Plus, deep integrations with the merchant portal on Commerce Studio enables banks to combine their existing portfolio and manage their offers.

Commerce Studio harnesses the power of maya.ai to clean data, map associations and preferences, at scale. The ‘suggested merchants’ feature helps banks find merchants across categories where their customers are actively transacting. It analyses trends, discovers patterns in customer behaviors and looks for ways to increase portfolio spends

Suggested Merchants: Seen and unseen strategic partnerships

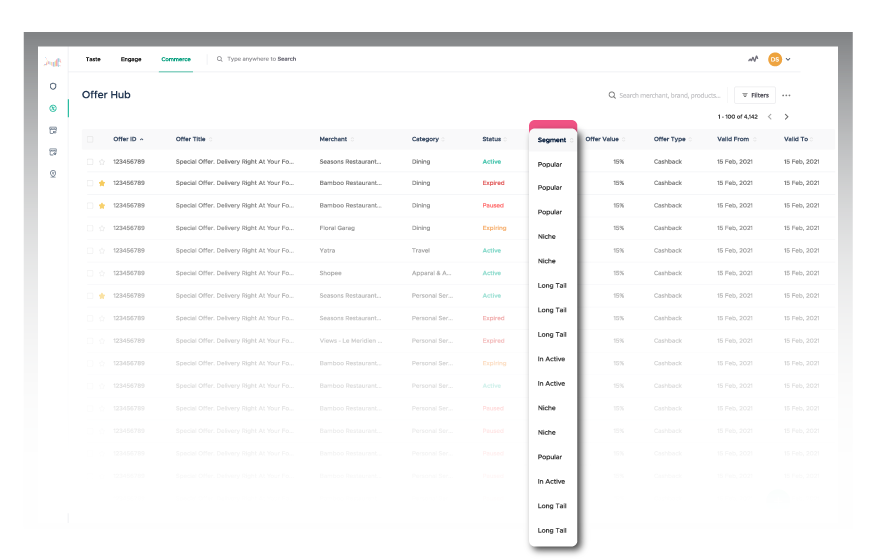

The ‘Suggested Merchants’ feature houses essential decision-making parameters for portfolio managers or their counterparts within the enterprise ecosystem. This enables the enterprise coverage across the entire spectrum of:

Merchant segments:

Typically, when banks institute cobranding opportunities, they seldom look past the most popular merchants in any given category. They want to showcase the offers and merchants that appeal to the largest cross-section of their customers. In doing so, they miss the opportunity to engage with merchants in the mid-range segment, which contributes an additional 30-40% revenue to the transaction portfolio. This underrepresented segment of merchants (and customers) becomes exponentially significant.

Categories:

Needless to say, banks aggressively populate offers from categories that have the highest yielding transactions from their user base. It is important to trail the visible trends. However, the past two years have proved that it is equally important to gear up for any unforeseen changes in the economic climate and buying patterns.

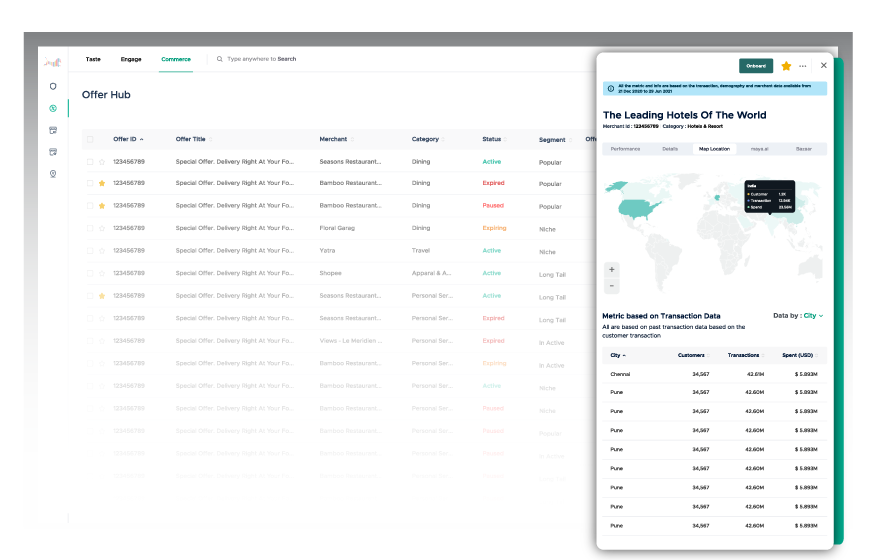

Geographies:

Places with high population density have greater economic development. To banks, this translates as greater offer density, which results in greater affiliate revenue. To put this in perspective, in densely populated countries like India, 100,000+ merchants operate. And large banking enterprises have tens of millions of customers on average. But an overwhelming majority of these merchants suffer from lack of visibility because enterprises only take the top [hundred or so] brands into consideration. Enterprises will now have greater flexibility in offer distribution as opposed to endlessly rotating the limited offers in their kitty.

We’ll let you in on a best kept secret: None of the banking enterprises have optimized all three areas as well as we have! And we have the data to prove it.

One of our clients, a leading bank in India, needed to increase spends from certain customer segments. Their target demographics was customers from semi-urban locations. maya.ai’s commerce studio identified popular and up-and-coming merchants with high affinity to customers in those areas based on location. These hyperlocal campaigns generated ~80 Mn in incremental revenue (26% above the target value).

If you’re wondering how all of this comes together, we’ve got a solution for that too: The Engage App. Want to learn how personalization could benefit your organization?

![maya.ai: the AI platform powering the age of relevance [Demo]](https://crayondata.ai/wp-content/uploads/2023/08/the-AI-platform-powering-the-age.png)