Today’s customers are digital natives. Irrelevance annoys them. Studies show that 85% expect personalized services, while 67% expect personalized experiences. These are not numbers that can be ignored. Banks that are early adopters to the age of relevance can be part of an 800 Bn USD personalization-led shift in revenue. In this series, we’ll explore if banks around the world are ready for this change. This week, we look at Brazil.

In the Forbes list of world’s best banks, announced in April 2021, Nubank ranked #1 in Brazil. They have one thing in common with the next five banks on the list – Banco Inter, C6 Bank, PagBank, Neon and Next. All of them are neobanks. These and other fintech players have collectively raised VC funding to the tune of 1 Bn USD in 2020 alone. There’s a lot on the line for traditional banks.

Going where the consumers are: online

With an internet savvy population, of which 76% make online purchases, these banks have carved a comfortable niche for themselves in the South American nation. Online sales revenue jumped by 41% in 2020. This was the largest percentage hike since 2007. As for the volume, more than 194 million orders were placed by Brazilian consumers.

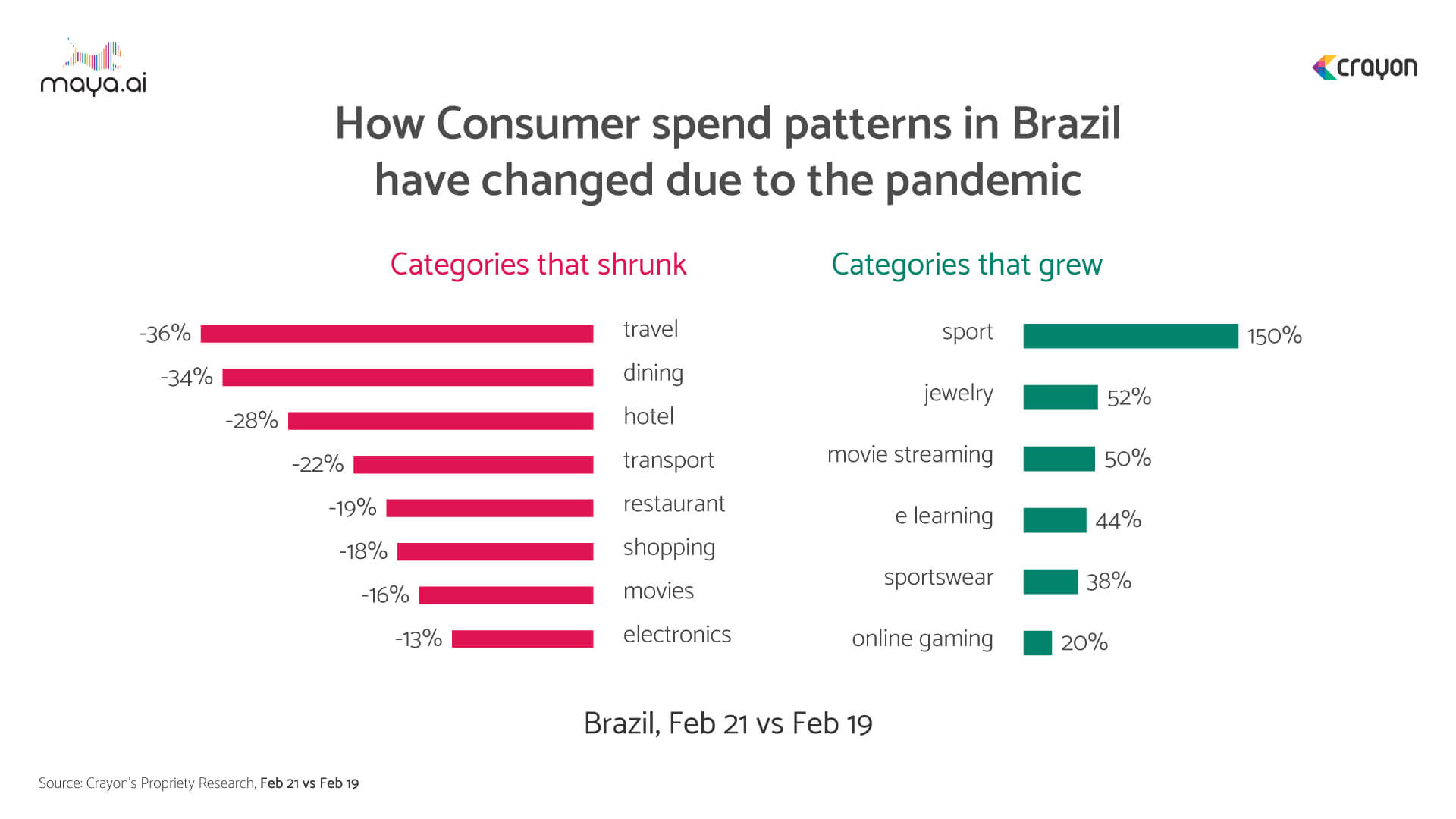

Spend patterns during the pandemic dipped in the universally affected categories. Travel, dining, hotel, movies and shopping shrunk. Meanwhile, sports enjoyed a 150% growth. Since one must have the right accessories, sportswear too grew by 38%. And strangely enough, jewelry saw a spike as well. Movie streaming, e-learning and online gaming were other areas of growth.

Digital wallets on the rise

It’s not just neobanks that are cashing in on this trend. During the pandemic, digital adoption skyrocketed. 61% of smartphone users started using digital wallets. Now, they’re used for one in five e-commerce spends. There has also been 2.6 times growth in POS spends using this payment method.

And consumers have hundreds of options to choose from. Even food delivery aggregators like iFood and Rappi are getting in on the digital wallet action. In addition to PIX, that is. It’s an instant payment system from the Central Bank of Brazil that enhances the interoperability of wallets with QR codes to facilitate real-time payments and transfers. The total transaction value is set to grow at a CAGR of 14.6% to 156 Bn USD in 2025.

How can traditional banks in Brazil adapt and thrive in this scenario?

Crayon Data’s Relevance Quotient (RQ) is a proprietary framework used to analyze offers on bank websites and social media presence. On a global scale, 71% of banks struggle to create a 360-degree view of their customers. This in turn affects the quality of relevant services and personalized offers they can provide. 56% of customers also demand better omnichannel experiences.

Banks in Brazil could be losing 100s of millions of USD because of this current state of irrelevance. And it’s not just the unbanked population of 70 Mn that’s at stake. They also risk losing 20 Mn active accounts. To stem this flow, they’ll have to partner with banking personalization experts. After all, there’s the opportunity to be part of an 800 Bn personalization revenue shift.

Platforms like maya.ai work to create a 360-degree view of customers based on their profiles and preferences. Merchants on our Bazaar platform give a wide range of relevant and personalized offers to choose from. To schedule a free demo with our personalization experts, share your details.

More from the #CountryInFocus series: Philippines, UAE.

![Slaves to the Algo: AI podcast by Suresh Shankar [Season 1]](https://crayondata.ai/wp-content/uploads/2023/07/AI-podcast-by-Suresh-Shankar.jpg)

![Slaves to the Algo: an AI podcast by Suresh Shankar [Season 2]](https://crayondata.ai/wp-content/uploads/2023/08/version1uuid2953E42B-2037-40B3-B51F-4F2287986AA4modecompatiblenoloc0-1.jpeg)