Today’s customers are digital natives. Irrelevance annoys them. Studies show that 85% expect personalized services, while 67% expect personalized experiences. These are not numbers that can be ignored. Banks that are early adopters to the age of relevance can be part of an 800 Bn USD personalization-led shift in revenue. In this series, we’ll explore if banks around the world are ready for this change. This week, we look at Indonesia.

Indonesia is one of the world’s largest unbanked markets: 180 Mn do not have bank accounts. The island nation also has 175 million Internet users, the highest in South-East Asia. That’s about 64% of the total population. Of these, 88% have made an online purchase.

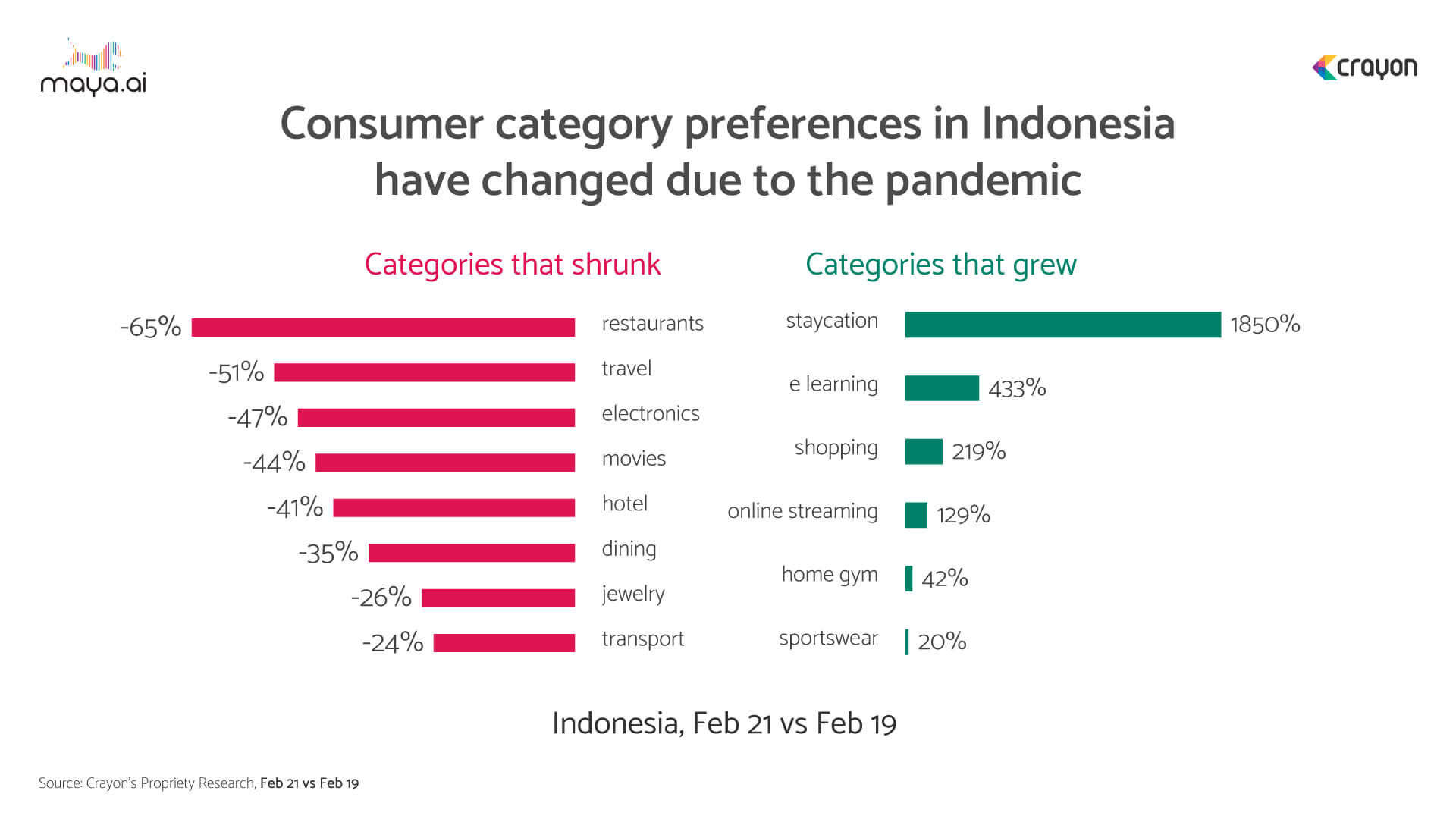

The pandemic has also changed consumer category preferences. Like the rest of the world, restaurant, travel, movie, hotel and transport segments have taken a dip. Staycations, on the other hand, have seen a whopping 1850% increase! E-learning at 433%, shopping at 219% and online streaming at 129% are other sectors that have seen spectacular growth.

Little wonder then, that tech giants are lining up to enter the Indonesian market.

According to a report in Al Jazeera earlier this year, this is an “opportunity to reach more than 83 Mn people – nearly a third of its population – who still lack access to formal financial services”.

Since the country is one of the few who do not offer licenses to digital-only banks, the race is on to acquire smaller banks to run as digital arms. The article continues, “[Indonesia’s] Financial Services Authority is pushing for more consolidation among its more than 1,600 commercial and rural banks in lieu of issuing new licenses.”

As banks and authorities figure out a way forward, e-wallets have become popular.

Three out of 10 e-commerce purchases are completed using wallets. And in the past year, there has been a 2.8% growth in point of sale spends using this payment method. Simultaneously, the number of wallet licenses have also increased. Of 51 digital wallet licenses, 70% are from non-banks. They have seen over 5 Bn transactions, with a total value of 10 Bn USD. This number is expected to increase over five time by 2025.

But how relevant are Indonesian banks?

Crayon Data’s Relevance Quotient (RQ) is a proprietary framework used to analyze offers on bank websites and social media presence. When we evaluated 10+ banks in Indonesia, we found that less than 1% delivered personalized offers. Over 80% have broken fulfillment journeys, and only 30% surface offers across social channels. Moreover, less than 40% of banks

- Surfaced relevant offers to customers during the pandemic

- Provide any functionality to discover offers on digital assets

- Engage with customers on all digital assets they have

Bank Mandiri (48%), CIMB Niaga (47%) and Citi (43%) are top ranked according to the RQ framework. What’s at stake? 36 Mn active accounts could be lost to neobanks. Across the board, there needs to be more awareness of customer preferences. This will help in increased personalization, choice fulfillment and engagement.

Platforms like maya.ai work to create a 360-degree view of customers based on their profiles and preferences. Merchants on our Bazaar platform give a wide range of relevant and personalized offers to choose from. To schedule a free demo with our personalization experts, share your details.

More from the #CountryInFocus series: Philippines, UAE and Brazil.