In the first of a series of blogs, we explored what personalized marketplaces are, and why they are important to banks, merchants and consumers. Then, we took a deep dive into how banks can thrive with a marketplace strategy that is built for each customer. Today, we explore why a bank’s personalized marketplace is the place to be for merchants and retailers.

“In a world of abundance, being able to aggregate demand is more valuable than being able to create supply,” says American analyst Ben Thompson. That’s exactly what marketplaces do for merchants.

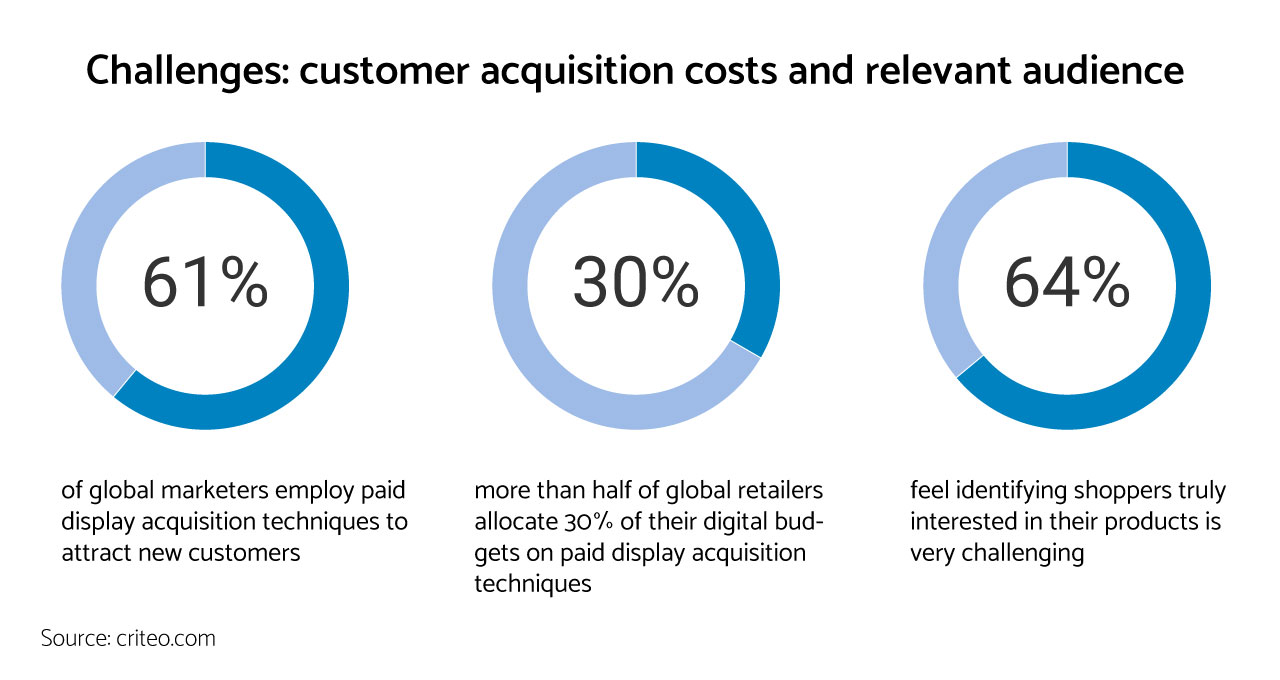

Post 2020, the retail industry has been playing around with different strategies to stay afloat in a world gone online. Acquiring relevant customers and increasing wallet share is the focus. And it’s a challenging one.

It takes more effort – and money spent – to get a customer to click through to a standalone ecommerce store. Let alone complete a purchase. This doesn’t include the marketing spends to retain customers. Those who were loyal to the brand offline may get swept away by shinier, appealing offers online.

Here’s where personalized marketplaces come into play.

Especially those that are tied into banks. Banks have customers. They have the data on what these customers like to spend on and what categories they prefer. Banks want to stay relevant to the customer’s lifestyle by presenting them with offers they can use. Customers then feel heard and seen and develop a better relationship with the bank.

Can this symbiotic ecosystem be made better? Yes.

When merchants come on board and present the relevant offers that both banks and customers are looking for. This subsequently increases their own revenue. With a third-party marketplace platform like maya.ai’s Bazaar, for instance, merchants can increase bank customer spends on their brands by 3x to 10x. Personalization and transaction data are the key drivers to adding these new customers.

Why bother with the personalized marketplace?

Like all new things that require an investment, change in strategy, or mindset shift, there are always questions. Some of the FAQs we’ve encountered while introducing Bazaar to retailers include:

- We know our customers and customer segments better than anyone else. Why should we go to a third-party platform?

- We have our own data analytics. Do we really need someone else to come in and make sense of it?

- We’re focusing our digital marketing efforts on social media. Why shift to banks as a channel?

We’ll give merchants three reasons to pick personalized marketplaces.

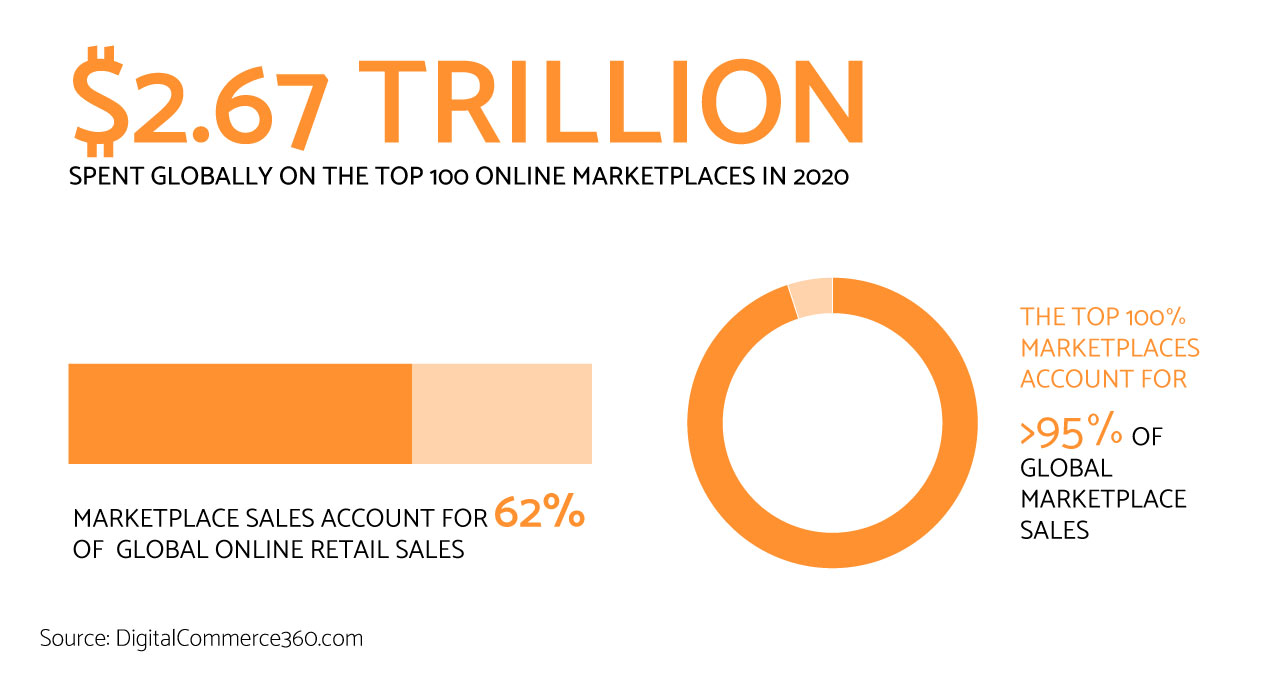

1. It’s all in the numbers.

In 2020, top online markets globally sold 2.7 Tr USD. Large digital storefronts like Taobao or Amazon might seem like the way to go. But in a crowded space, it’s easy for smaller retailers or local merchants to get lost in the mix. But in a personalized banking marketplace, it’s much simpler. Merchants are paired only with relevant customers. All that’s left to do is present them with an offer they can’t refuse.

2. Advertising spends.

Currently, online retailers spend around 25% of their sales to drive traffic to their site. This doesn’t always lead to conversions and ROI. So, merchants are hit with a double whammy of little traffic and high cost of acquisition. On a banking marketplace, your targeted customers are already on the platform. You don’t have to go looking for them. Or lure them in. Both short term and in the long run, it’s cheaper than Google or Facebook ads.

3. Data matters.

As the world opens up, revenge spending on shopping, travel and dining are expected to increase. Merchant analytics are limited to those who have visited or shopped on their site. A platform like Bazaar, on the other hand, can share key customer segments, areas where spends are increasing, campaign data and performance statistics as well.

To speak to one of our personalization experts, share your details in the form below.

![Slaves to the Algo: AI podcast by Suresh Shankar [Season 1]](https://crayondata.ai/wp-content/uploads/2023/07/AI-podcast-by-Suresh-Shankar.jpg)

![Slaves to the Algo: an AI podcast by Suresh Shankar [Season 2]](https://crayondata.ai/wp-content/uploads/2023/08/version1uuid2953E42B-2037-40B3-B51F-4F2287986AA4modecompatiblenoloc0-1.jpeg)